Source: Wumian Finance

Author: Chen Xinmiao

Editor: Lei Zhizhi

Design: Budong

Editor’s Assistant: Zhu Zhiqi

The real estate brokerage market is surging.

Who would have expected that Ke Holdings Inc. (NYSE:BEKE, hereinafter referred to as "Shell"), which has been controversial all the way, could become the darling of capital. Since its listing in August 2020, its share price has been rising all the way, and its market value once reached 600 billion yuan. Today, its market value is still as high as 560.674 billion yuan (US$ 86.522 billion), killing a number of leading real estate enterprises such as "Bi Rong Wan Heng" and firmly taking the first place in the industry.

▲ Ke Holdings Inc. rings the bell, and the market performance is unexpectedly good. The picture comes from the internet.

At the beginning of the shell’s birth, it was impossible to sit still in the same city, but it seemed like another scene. In 2019, 21st Century Real Estate and Zhonghuan Internet have turned their backs on each other. By the end of 2020, World Bank announced in a paper that it had withdrawn from the new house joint sales platform 58 Aifang together with the same policy consultation. In the past, the "anti-shell alliance" was a mess.

58 series has fallen into the wind, but in the face of the fierce growth of shells, the Internet, developers and other capitals rushed into the "blue ocean" of the real estate trading market. Much attention has been paid to the online real estate trading platform "Tmall Good Room" launched by Yiju and Ali, with the intention of providing the industry with another choice besides shells; Evergrande acquired companies and stores on a large scale, and set up RV Bao Group to benchmark shells. The future journey is trillions of valuation, packaging and listing.

In the face of crisis and temptation, the forces of all parties are changing, and the smoke of war has already filled the air.

Shell alone according to c position"We are making a stadium, and more and more people want to play football here, and the rules are getting better and better." Zuo Hui once described shells with football. In his view, the nature of the industry is changing, and what shells do is to rebuild the ecology of the whole industry centered on store managers and brokers.

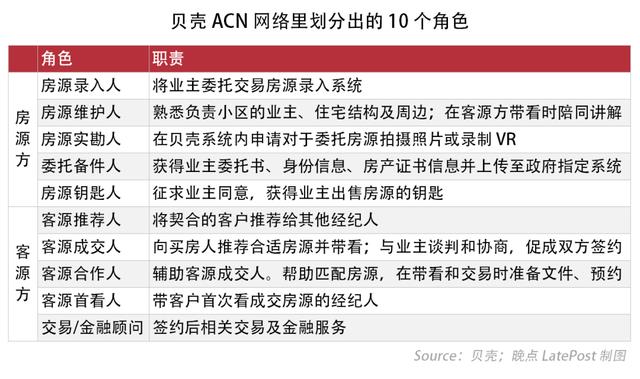

To a large extent, the shell’s confidence comes from the real estate dictionary and ACN (broker cooperation network) two methodologies. These are the two moats that the chain used to be, and now they have become the bottom rules for real estate brokerage brands to settle in shells.

Under the platform rules, the real estate transaction process is divided into multiple links, and brokers are encouraged to cooperate with each other, participate in different links and share the benefits; Brokerage brands on the platform can share all real listing information indiscriminately.

▲ Shell’s ACN network splits the real estate transaction process into multiple links, in which various roles play different roles. Image from late LatePost.

You know, before the shell, there were no rules in the extensive development of the real estate brokerage industry, and the shell was undoubtedly the one who ate crabs. Different from the ordinary internet platform, Shell tries to define the basic measures of house transaction in a closed-loop intercommunication mode, which strongly controls the rules of the platform, and intends to strengthen the information interaction of brokers and improve the transaction efficiency.

But the controversy of "being both an athlete and a referee" also comes from here, and shells need to prove themselves urgently. However, at present, the shell model has worked.

Switching from direct operation and franchise mode to platform mode, in just over two years, Shell has been attacking the city, and entered the capital market in August 2020, becoming the largest real estate transaction and service platform in China, with a GTV of 2.13 trillion yuan (the total transaction volume of the platform) second only to Alibaba in China.

After listing, the shell scale effect is still expanding. In the third quarter of 2020, the GTV (total trading volume of platforms) reached 1.05 trillion yuan, an increase of 87.2% year-on-year; The operating income was 20.5 billion yuan, a year-on-year increase of 70.9%. In the first three quarters, the accumulated GTV and revenue of the shell platform have exceeded 2.13 trillion yuan and 46 billion yuan in 2019.

Looking at the industry, shells are also far ahead. Based on the national housing transaction volume, the market share of shells in 2019 was 9.5%, while the market share of mainstream brokerage companies represented by Zhongyuan Real Estate, I Love My Family and Leyoujia was only 4.3%, 1.9% and 1.3% respectively.

In addition to scale, cross-store brand cooperation and store efficiency are also data that Shell is willing to share with the outside world, which proves that its rules are effective.

From 2018 to the first half of 2020, the number of non-chain stores increased from 8,136 to 34,547, and the number of brokers increased from 60,900 to 321,800, which has achieved significant growth since the birth of the shell (April 2018). According to CIC report, in 2019, the single-store transaction volume of shell platform was 1.6 times that of the industry, and 70% of the stock house transactions came from cross-store transactions.

During this period, real estate brokerage brands such as 21st Century Real Estate, Central Real Estate and Dwelling House settled in Shell. In addition, after the restart of the franchise brand Deyou, it is also attracting small and medium-sized intermediary brands from all over the world.

Taking the Wuhan market as an example, according to the "Prism" news, Xie Juan, the chairman of Wuhan Fangrong Company, said that in early 2019, the company’s three major brands had more than 600 stores, and under the strong attack of Shell, nearly 200 stores were lost in September.

However, the shell that occupies the super C position in the industry is facing the torture of whether it will become an industry monopolist.

For example, in September 2019, representatives of 100 real estate agencies in Jinhua, Zhejiang Province jointly signed the Anti-Shell Alliance Treaty, and 530 stores in the alliance shouted "Oppose monopoly and resist unhealthy competition"; In April 2020, 100 intermediary companies in Yancheng, Jiangsu Province also rebelled against the shellfish system on the grounds of "resisting bad competition".

58 alliance collapseCompared with the highlights of shells, the "anti-shell alliance" initiated by 58 cities in the past is now an exit, and the momentum of defection is not as good as before.

The real estate information platform under the same city is an important source of revenue. But the shell moving from offline to online undoubtedly moved its cheese.

To this end, in June 2018, 58 cities launched a real estate alliance, wooing brokerage brands such as I love my family, Zhongyuan Real Estate, 21st Century Real Estate China, and Zhonghuan Internet, shouting "58 will never be self-employed" and pointing to shells; Ten days later, 58 City became a strategic shareholder, I love my family, and the curve cut into the real estate agency industry.

▲ The swearing-in meeting on the platform of Yao Jinbo Zhang Luo and Zhongzhong Brokerage Company pointed out that the opponent was naturally the shell that was not present. The picture comes from the internet.

However, the "anti-shell alliance" is not solid, but more like a rush to hold a group when facing the unknown new thing of shells. Less than a year after the alliance, the real estate in the 21 ST century will "surrender" to the shell; In the same year, Central Internet and I love my family, but they failed to reorganize, and turned to cooperate with Shell.

Nearly 9,000 stores under the two brand brokerage companies have entered the shell, which is undoubtedly a heavy blow to 58 cities. According to media reports, since 2019, in order to prevent more intermediary companies from accessing the shell system, 58 cities have spared no effort to ban "shell takers", and the "two-choice-one" dispute has intensified in the intermediary industry.

In 2020, the number of allies in 58 cities will continue to decrease. Prior to this, in 2019, 58 cities, World Bank and Tongce Consulting jointly established the new house joint selling platform 58 Aifang, with the intention of grabbing the new house distribution market with platforms such as Shell and Yiju. However, by the end of the year, World Bank and Tongce Consulting both withdrew and transferred 55% of their shares in 58 Aifang to 58 cities.

Behind the "breakup" is the continuous loss of 58 love houses. According to the announcement of World Bank, the competition in the field of new house joint selling platform is fierce, and it is still in the early stage of investment and loss. In 2019, Shanghai Geng Ying Net (the operating entity of 58 Aifang) lost 95.74 million yuan; From January to September 2020, the net loss further expanded to 172 million yuan.

Jiang Han, a senior researcher at Pangu think tank, believes that there is no way to evacuate Tongce and World Bank. For the whole market, 58 Aifang has not formed its own hematopoietic mechanism and relatively strong market competitiveness. The final result is that the participants have not gained their sense of belonging and hope for market development.

Not only that, I was particularly active in the process of shelling shells. I publicly stated that "the platform that is both online and offline is not acceptable to us in business ethics and operational logic". I love my family and was reduced by 58 cities in August last year. After the reduction, the shareholding ratio of 58 cities will be reduced to 4.99%.

Although the gambling was successfully completed, I love my family’s scale expansion in recent years, and the scale of channels and houses is far less than that of shells. There are tens of thousands of stores and trillions of transactions with Shell, and I love my family. These two indicators are still in the stage of hundreds of billions.

Teammates defected, the alliance split, and allies didn’t give strength. So it seems that 58 cities have already fallen behind in this platform dispute provoked by themselves.

However, 58 cities are still sticking to their teeth. Its CEO Yao Jinbo once publicly compared Apple and Android phones to Shell and 58. "It is hard to say that Apple phones are open platforms, but Android phones are open platforms and can be produced by many people."

On the occasion of the listing of shells last year, Yao Jinbo, CEO of 58 City, wrote in a circle of friends: "Today, shells are listed, and congratulations are extended to General Manager Zuo Hui. But responsibly speaking, we believe that the open platform Android will be greater than closed, and 58 Anjuke will enter/empower the industry in all directions after delisting! "

In addition, 58 love houses has become a channel for 58 cities to compete for intermediary resources. According to Tianyancha data, 58 Aifang actually controls 193 companies, most of which are local intermediary brands, including Chongqing Home, Guangxi Youju, Changsha Seagull, Wuhan Nuojia and Anhui Zhongshu Real Estate.

The giant is a powerful spoiler.In the face of crisis and temptation, housing enterprises and Internet tycoons can’t sit still.

It is hard to imagine that the shell from the hard work of the intermediary can create a market value of over 500 billion yuan, which is undoubtedly a huge impact on the high-ranking housing enterprises in the past. When most housing enterprises are facing channelization, shell’s right to speak is also increasing. According to the third quarterly report of 2020, the transaction volume of shell new houses increased by 105% year-on-year to 420.7 billion yuan, and the revenue of new houses has surpassed that of second-hand houses.

Evergrande took the lead in rushing out of a group of real estate enterprises, launched RV treasures and benchmarked shells, with the ultimate goal of listing.

At the end of December last year, Xu Jiayin officially unveiled RV Bao Group, and announced its three major departments: RV Bao National Brokerage Platform, RV Bao Platform and RV Bao SaaS Management Platform, covering transactions of new houses, second-hand houses, new cars and used cars, as well as home improvement and car user services.

The growth of RV Bao began with a large-scale collection of intermediaries, and the path was huge subsidies. "I give you money and you give me traffic resources; I don’t want your money, but you have to obey the management and we will go public together, "RV Bao wrote in the cooperation mechanism.

The speed soon appeared. According to the data of Evergrande, RV Bao Group was reorganized and established by Evergrande and 152 intermediaries in the second half of 2020. At present, there are 30,635 offline stores with an annual transaction scale of 1.2 trillion yuan. In contrast, the corresponding data of shells are 42,000 and 2.1 trillion.

According to the blueprint drawn by Evergrande, the valuation of RV Bao will reach 6 trillion yuan in 2023 and it will be listed in 2024. And RV Bao now values itself at 67.7 billion yuan.

At present, most of the RV treasures are Evergrande’s houses, and it is not known whether it can become an open platform in the future. However, the market space left for RV Bao is still very large.

According to CIC report, the total amount of real estate transactions in China will reach 30.7 trillion yuan in 2024, and the compound growth rate from 2019 to 2024 will reach 6.6%. Although shells are strong, their market share is less than a quarter at present.

This point has also been taken seriously by Internet giants such as Alibaba, JD.COM and ByteDance.

Shortly after the shell went on the market, Ali joined hands with E-House to launch "Tmall Good House" and launched the real estate transaction cooperation mechanism (ETC), providing four trading scenarios: new house, second-hand house, special room and auction room, with more than 60 real estate enterprises such as Vanke, Country Garden and Evergrande as their platforms.

According to the plan, Tmall Haofang will not make money for at least the next three years, and all income will be 100% subsidized by buyers.

Zhou Xin, chairman of Yiju, believes that the traditional brokerage industry is fragmented, and the appearance of shells provides the first choice for the industry, while Tmall Haofang provides another choice for institutions and brokers who are unwilling to be bound by too many rules. "I don’t think there is right or wrong, it’s just a matter of choice."

But then the war started. Last year’s Double Eleven, Tmall Good Rooms and Shells concentrated on the promotion of new houses. From the open battle report, Tmall Haofang entered 236 cities through cooperation with 302 developers, with a GTV of over 93.1 billion yuan. In contrast, Ke Holdings Inc. only claims to cooperate with 90% of the top 100 housing enterprises, with a GTV of less than 36.8 billion yuan.

In addition to Ali, JD.COM is also making efforts. During the Double Eleven last year, it opened more than 800 "Haofang Jingxuan" stores in Guangzhou, Dongguan, Huizhou and Tianjin.

Hu Jinghui, chief economist of Jinghui think tank, believes that compared with the loose defensive alliance form before, all the new entrants have the support of big capital, and with the influx of various forces, one or two forces that can really fight against shells may be formed in the future.

In the process of competition among all parties, scattered small and medium-sized brokerage companies are more likely to become the target of poaching. According to the data of Qianwei.com, 70% of small and micro intermediaries have completed more than 50% of the transaction volume in the second-hand housing market.

Ping An Securities pointed out in its research report that under the demands of the head office to scale up and expand channels, the expansion speed of the heavy asset direct sales model is limited, and the light asset platform joining model has become an important means of scale growth, and the competition for resources of small and medium-sized stores in the region is becoming increasingly fierce, driving the industry concentration to accelerate, showing a situation of strong and strong.

Reporting/feedback

关于作者