The momentum of international big names has not diminished. What can the head of domestic products spell from the 2022 financial report?

Since last year, the trend of head domestic beauty cosmetics and international big names "positive" has surfaced.

According to the financial report, in 2022, international beauty companies such as L ‘Oreal, Beiersdorf, Coty and LVMH achieved more than 15% revenue growth, and the growth momentum in the China market continued unabated.

At the same time, the domestic beauty cosmetics represented by Polaiya, Winona, Run Baiyan and Quardy are also constantly advancing with their product strength and scientific and technological strength, and the ranking rate in double 11 and other big promotion lists continues to increase, and the market competition between international brands and domestic beauty cosmetics is becoming increasingly fierce.

Recently, the 2022 performance of head listed companies such as Polaiya, Huaxi Bio, Betani and shanghai jahwa has been fully announced. According to the financial report, the revenues of Polaiya, Huaxi Bio and Betani have increased by more than 20%, which is better than the market.

According to the data of the National Bureau of Statistics, last year, the total retail sales of cosmetics above designated size in China’s consumer goods was about 393.5 billion yuan, down about 2.25% year-on-year. In the fierce market competition, the differentiation period of beauty companies has arrived. Under the market trend of changing from flow bonus to quality bonus, high-quality development has become an important direction for major brands and companies to adjust their strategies.

According to the observation of Cosmetics Daily, at present, Polaiya, Huaxi Bio, Betani and shanghai jahwa are all in different stages of multi-brand matrix building for the sake of improving their anti-risk ability or seeking the second growth curve.

At present, in addition to the main brand Polaiya, Polaiya has also cultivated several sub-brands, such as Caitang, Yuefu, Off&Relax, which are respectively positioned as professional makeup, oily skin care and high-end care for new national makeup artists.

Since entering the C-end in 2018, Huaxi Bio’s multi-brand operation ability has been verified, and it has run out of two billion-level brands, Runbaiyan and Quady. In 2022, there were nearly 10 single products with sales exceeding 100 million yuan. At present, Huaxi Bio’s four functional skin care brands, Runbaiyan, Kwadi, BM Muscle Activity and Mibel, have entered the stage of large-scale development and formed a differentiated technical route.

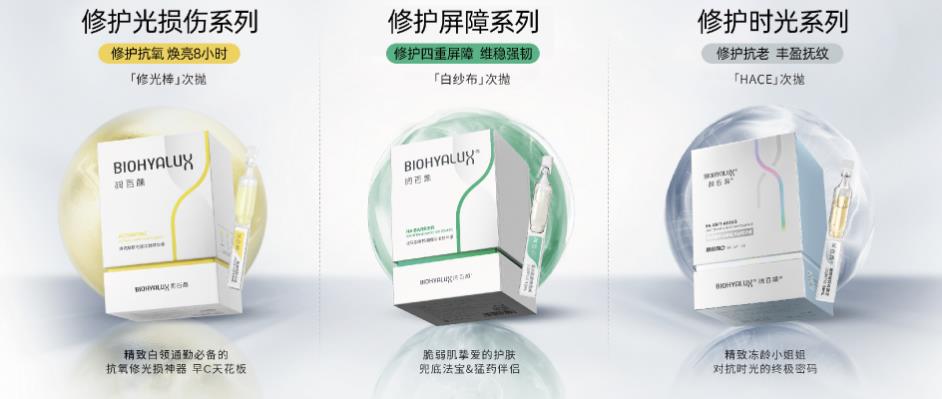

Among them, Runbaiyan inherited the highest technical level and latest research results of Huaxi Bio in the field of hyaluronic acid, upgraded its brand positioning, and put forward the concept of "hyaluronic acid technology repair aesthetics" with "repair" as its core effect; Quadi focuses on the anti-aging track; Mibel aimed at sensitive muscles; BM muscle activity locates people with oily skin.

This year, under the brand matrix strategy of "focusing on the main brand Winona and expanding the sub-brands", Betani is also gradually improving the market position of Winona Baby, Kewan and Bevertin, and looking for the second growth curve.

Shanghai jahwa, which owns brands such as herborist, Yuze, Liushen, Diancui, Meijiajing, Gough, etc., has also formed stable and differentiated brand assets, and continues to focus on the upgrading iteration of main brands such as herborist, Yuze and Gough.

With the evolution of consumers’ cognition of cosmetics and the continuous improvement of cosmetics laws and regulations, the era of producing products in the workshop and selling hope in the market has become history. Since the implementation of "Evaluation Standard for Cosmetic Efficacy Claims" in May 2021, China cosmetics have ushered in the first year of efficacy, and the whole beauty industry has entered a critical moment of "technical competition".

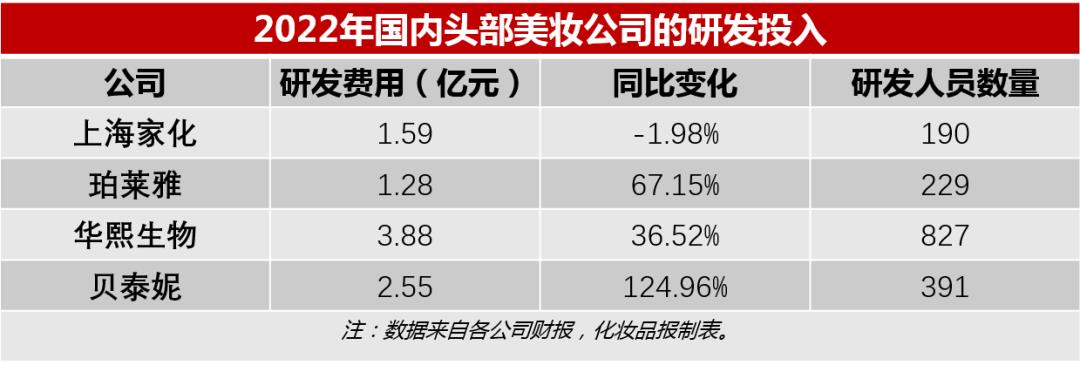

In 2022, the research and development expenses of head beauty companies continued to climb. Huaxi Bio is a biotechnology and biomaterial company, and its R&D investment in the domestic beauty industry is far ahead, reaching 388 million yuan in 2022, up 36.52% year-on-year; Betaine’s R&D expenditure was 255 million yuan, up 124.96% year-on-year; Polaiya invested 128 million yuan in R&D, a year-on-year increase of 67.15%.

Last year, in the field of beauty research and development, the world’s leading technology synthetic organisms became an important landing tool for domestic and foreign brands to seize the beach. "Synthetic biology is the most basic discipline leading to future technology, and it even surpasses chips in the dimension of global competition." Zhao Yan, chairman and general manager of Huaxi Bio, once said.

In recent years, domestic and foreign beauty companies have continued to overweight synthetic biology. In August last year, Shiseido accelerated the layout of synthetic biology by investing in Chuangjian Medical. In July last year, L ‘Oré al joint investment institutions and Blue Crystal Microbes jointly launched the Tiangong Kaiwu Bio-economic Industry Acceleration Platform, which is also an exploration of synthetic biology.

It is worth noting that Huaxi Bio was one step ahead and laid out synthetic biology as early as 2018. At the beginning of many beauty companies, Huaxi Bio has now completed all the links of "platform-talent-technology-transformation" needed by synthetic biology. Last year, Huaxi Bio-International Innovation Industrial Base of Synthetic Biotechnology settled in Daxing, Beijing, and put it into use, and comprehensively laid out the industrial system of bioactive substances around six categories of substances: functional sugar, amino acid, protein, polypeptide, nucleotide and natural active compounds.

According to the financial report, by the end of last year, the R&D team of Huaxi Bio-Beijing International Innovation R&D Center for Synthetic Biology had introduced more than 50 researchers from Chinese Academy of Sciences, Tsinghua University, Cornell University in the United States and Chalmers Institute of Technology in Sweden, and set up five synthetic biology R&D studios, a fermentation optimization platform, an application R&D studio and platform management to provide intellectual support and technical support for the synthetic biology industry.

In terms of product strategy, creating a large single product with long life cycle and high repurchase is becoming the common choice of head beauty companies such as Polaiya, Huaxi Bio and Betani.

"In addition to enhancing brand awareness, the significance of big items for beauty companies lies in the optimization of production costs and the reduction of brand communication costs." Fan Yuan, vice president of Huaxi Bio-business, told Cosmetics News at the 2022 financial report communication meeting.

Last year, shanghai jahwa’s herborist brand solved the problem of product series dispersion, and created four series of product lines by continuously simplifying the focus, among which the cumulative sales of the new Taiji line’s single product of water mark exceeded 100 million yuan.

In 2022, Polaiya also continued to deepen the "big single product strategy", expanded and upgraded the product categories and efficacy of the three family series of Double Antibody, Ruby and Yuanli, and introduced new products such as Yuanli Cream and Yuanli Mask, and upgraded the nightlight Eye Cream, Ruby Cream and Yuanli Essence, and successively launched version 2.0.

According to the financial report, last year, all major brands of Huaxi Bio completed the creation of one or more large single products or series of large single products. Among them, a product of BM muscle active brown rice water reached a revenue of over 400 million yuan in 2022. This year, Runbaiyan deepened the strategy of large single product, and under the idea of "layered repair and precise targeting", the products were sorted into three series: light damage repair series, barrier repair series and repair time series.

For beauty brands, it is not easy to create large items, which requires strong scientific and technological support and targeted R&D layout. For example, around the development of Winona special cream and other products, Betani has completed clinical research and effect observation of dermatology in 63 hospitals; Behind BM muscle-activated brown rice water is Huaxi’s innovative experience in the field of biological fermentation for more than 20 years. Runbaiyan’s hyaluronic acid secondary polishing essence series products have been iterated to version 3.0. In addition to the innovative application of medical technology, the world-leading hyaluronic acid technology is indispensable.

In the supply chain construction, domestic head beauty companies are improving their own production capacity, reducing the dependence on entrusted processing mode, and accelerating into the intelligent manufacturing stage.

At the end of 2022, Polaiya cooperated with Hangzhou Unicom to deploy 5G SA (Independent Networking) room subsystem for the AGV operation area of Polaiya factory, so as to realize the full coverage of 5G signals in the AGV operation area of the factory. In March this year, Betani invested nearly 500 million yuan, and the new central factory, which took nearly three years to build, was officially completed and put into operation, with an annual output value of 5 billion yuan.

As a platform enterprise of the whole industrial chain, from bioactive raw materials to medicines and health consumer goods, Huaxi Bio has always stressed that it is necessary to control the whole industrial chain in its own hands, covering key links such as technology and raw materials, pilot transformation and terminal market transformation, and the safety, stability and high efficiency of the industrial chain provide a strong backing for the production of skin care products. Since 2018, Huaxi Bio has been planning and starting Industry 4.0. At present, its production lines in Jinan, Chaohu, Tianjin, Haikou and other places have all been commissioned and used.

Conclusion:

With the younger generation of consumers’ recognition of domestic products with high cost performance and high quality, domestic beauty brands have ushered in a window of rapid growth. In the future, in the more fierce competition with international brands, if we want to maintain and enhance the market competitiveness, domestic beauty products should be forged by more scientific and technological strength besides products.

Based on the summary of the business strategies of domestic head beauty companies such as Polaiya, Huaxi Bio, Betani and shanghai jahwa, Cosmetics News believes that domestic brands need to have the following five abilities to achieve high-quality growth and resilient development.

1. Accurate and differentiated brand positioning.

2. Strengthen the insight into the real consumer demand and improve the agile product development system of "insight-R&D-verification".

3. Focus on innovation at the bottom, build large single products with long life cycle and build brand power from scientific and technological strength.

4. Pay attention to frontier technical fields such as synthetic biology, and build up competition barriers through independent raw material development.

5. Move towards intelligent manufacturing, improve its own production capacity, and reduce the dependence on entrusted processing mode.

关于作者