Author: Gao Teng

Original: Deep Eyes Finance (chutou0325)

After 8 years of long-distance running, under the noisy discussion, Netease Cloud Music finally went public on the Hong Kong Stock Exchange.

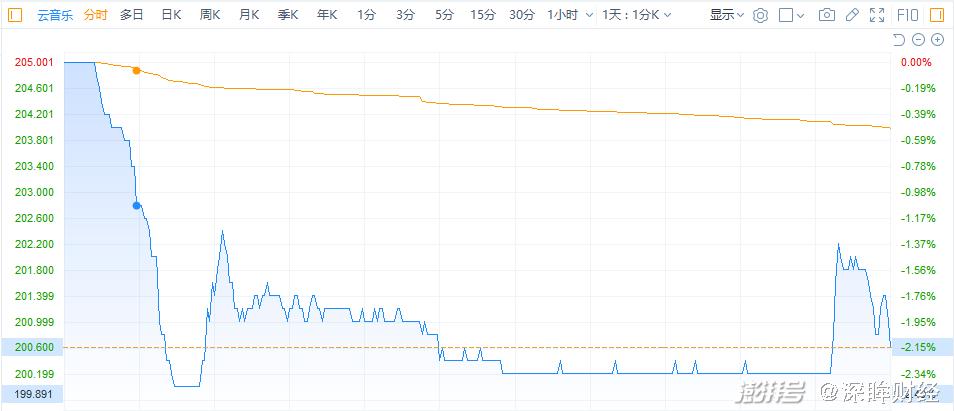

However, this jubilation also revealed a little embarrassment: with more than 80% cornerstone investors, Cloud Music (9899.HK) broke in the 12th minute of its first day of listing, and closed down 2.49% that day, falling below HK$ 200 to HK$ 199.9.

I have talked about the "feelings" for many years, and I have broken the ground in front of investors.

1, bloody listing, there will be acid behind the acrimony

For the first day performance of Netease Cloud Music, investors on Snowball have long been one-sided bearish, and keywords such as "cutting leeks, selling feelings, and rubbing heat" have a high frequency.

Even the Netease label behind it failed to arouse everyone’s confidence.

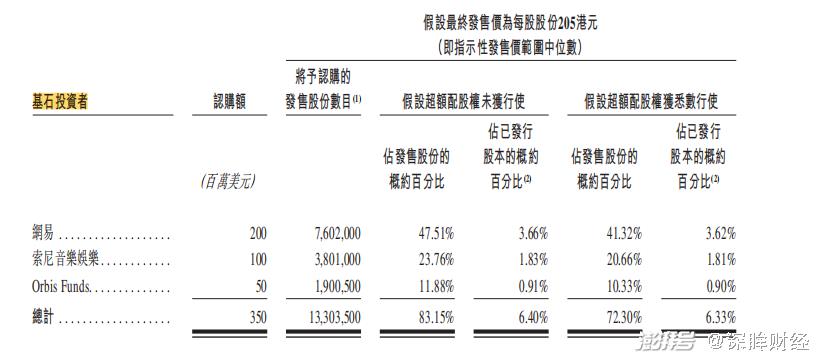

In this listing, Netease Cloud Music introduced Netease, Sony Music Entertainment and Orbis Investment Management Co., Ltd. as three cornerstone investors, with a total subscription of 350 million US dollars, exceeding 80% of the total public offering shares. By this means, the liquidity on the first day was locked up.

However, to boss Ding’s surprise, Cloud Music broke its hair cleanly.

In the case of a large proportion of cornerstone investors, Netease Cloud Music fell below HK$ 200 in just one hour. That is to say, only 20% of the investors made Cloud Music look gray on the first day, which is absolutely embarrassing in the history of IPO of Hong Kong stocks in recent years.

From this point of view, the role of cornerstone investors is more like a "sedan chair", and they will work together to send Netease Cloud Music to the Hong Kong Stock Exchange.

Moreover, from its "clever" listing opportunity, it just confirms its speculation of "cutting leeks". After all, if the opening of copyright is really a big plus, Netease Cloud Music can take off with it. Why rush to go public? Waiting for a year or two to go public, isn’t the market value higher?

If you are just short of money, it is better to directly raise funds from partners or Netease, and there is no need to go public in a hurry.

Therefore, we are more inclined to think that several cornerstone investors have a tendency of "non-long-term" investment, and as can be seen from the disclosure of the prospectus, the lock-up period of cornerstone investors is only six months, which is really "reluctant" compared with many cornerstone investors who have been inactive for several years.

2, three major problems, cracking is still no clue

In fact, from the twists and turns of Netease Cloud Music’s listing trip, we can see its guilty conscience.

On May 26, 2021, Netease Cloud Music submitted a prospectus to the Hong Kong Stock Exchange; August 1st, passed the listing hearing and uploaded the post-hearing data set; Seven days later, Netease Cloud Music announced that it would "consider suspending listing"; More than three months later, Netease Cloud Music restarted the IPO…… …

Behind all the actions, in fact, we have been closely following the news of "merger with Xiami Music" and "copyright opening", stepping on the tuyere in a down-to-earth manner and looking for the most favorable opportunity.

So, why should Netease Cloud Music be guilty? After carefully turning over the prospectus, "Deep Eyes Finance" found three main points.

First, huge losses are difficult to reverse, and user growth is in a bottleneck.

According to the prospectus, Netease Cloud Music’s operating loss reached 4.9 billion yuan in the past three years and exceeded 1.5 billion yuan in 2020, and its liabilities increased from 8.86 billion yuan in 2018 to 16 billion yuan in mid-2021. It is predicted in its prospectus that it will lose money for another three years.

This means that after the listing of Netease Cloud Music, it is extremely unlikely to rely on profit to boost the stock price, and Netease Cloud Music is also very embarrassed in key valuation indicators such as traditional users and payment rates of Internet companies.

The data shows that the user stickiness of Netease Cloud Music is not as strong as the outside world imagined. There are only 16 million paid members, and the payment rate in 2020 is 8.8%.

In this way, the traditional Internet enterprise-driven valuation model is not suitable for it at all, and in terms of development speed, competition difficulty, industry attributes, etc., Netease Cloud Music can’t support the stock price with only a few key indicators like Pinduoduo and biopharmaceuticals.

Second, copyright is still the main problem, but it is not hard enough to strike the iron itself.

In 2018, Tencent Music and Netease Cloud Music reached an agreement on the cooperation of online music copyright, and authorized music works to each other, reaching more than 99% of their own exclusive music works, and agreed to carry out long-term cooperation on music copyright, while actively opening music works authorization to other online music platforms.

However, in the core music copyright such as Jay Chou, Netease Cloud Music is still missing. The copyright that has not yet returned is essentially due to the failure of the transaction, and the most important thing in the business world is the spirit of contract. However, the past of Netease Cloud Music packaging and selling Jay Chou’s collection in the middle of the night before it was taken off the shelves in 2018 is too memorable.

Speaking of independent musicians, although it is claimed that 300,000 independent musicians have settled in, let’s not forget that Netease Cloud Music has repeatedly reported the news of "exploiting small UP owners" in terms of musicians’ terms, which is not the "Prince Charming" of independent musicians.

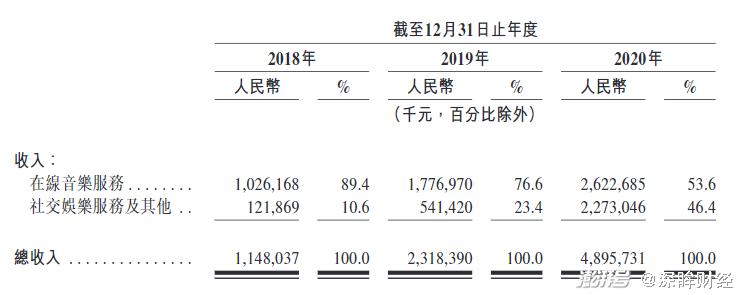

Third, the live broadcast is difficult to solve the temporary thirst, and it is difficult to support the high valuation by realizing the story.

In the case that copyright is at a disadvantage, Netease Cloud Music is eyeing the live broadcast. According to the data, the revenue of Netease Cloud Music, Social Entertainment and other sectors increased to 2.673 billion yuan in the third quarter (mainly from the sales of virtual goods, with live broadcast revenue as the main form).

However, the live broadcast service that was finally explored has passed the era of "collecting money" at will.

For example, as a representative of the live broadcast industry, Huya closed at $8.29 in the third quarter, far from the peak of $54.28. This shows that the era of the live broadcast industry has long passed, and the industry structure has basically taken shape. Netease Cloud Music wants to launch a new track in the non-outlet era, just like sailing against the current, which will definitely get twice the result with half the effort.

When a business misses the "time", it will be difficult to do anything. Rather than making money, it is better to say that it is temporarily undertaking the capital story of Netease Cloud Music. What’s more, it will provoke another kind of "involution" and turn the copyright dispute into a musician’s dispute. As a result, just like the game live broadcast industry in previous years, the ultimate key is to burn money.

In this way, Netease cloud music will be more difficult to get out of the quagmire.

3, mired in the whirlpool, the future is still unclear

If all these problems are superficial "slots", then another problem exposed in the prospectus may make investors more depressed.

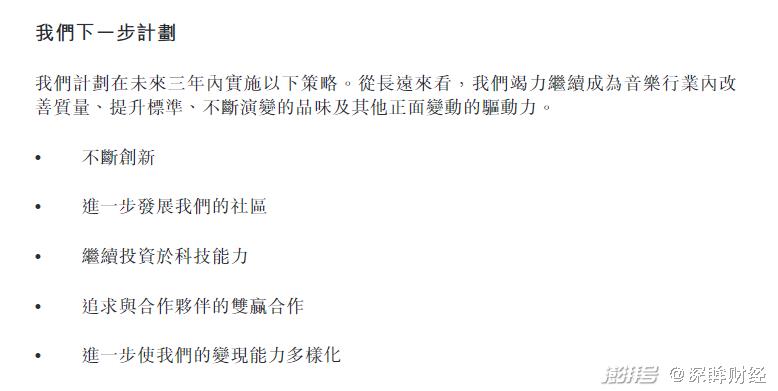

In the column of "Our Next Plan" in the prospectus, Netease Cloud Music did not clearly indicate the method and direction of realizing, but only explained with "continuous innovation" and "further diversifying our realizing ability", which shows that Netease Cloud Music is still at a loss in exploring the realizing path, or even has no clue. Combined with the first day of breaking, it is an iron fact that Netease Cloud Music is overvalued.

Of course, it is worthwhile for every investor to sum up and reflect on the overestimation of Netease Cloud Music. Shenyou Finance believes that Netease Cloud Music is overvalued step by step because it is good at using three points:

First, taking advantage of the concerns brought by industry attributes, it continues to cause contradictions and topics.

In the Internet era, the online music market has experienced ups and downs, from "copyright-free" to "copyright-owned" and then to "one super and many strong". Its development is not only related to the changes of many industries, but also the "sample" and "amplifier" of the Internet industry from the rough to the standard. Music has penetrated into everyone’s life, and the sky-high copyright and stars naturally bring their own topics, so the online music market naturally attracts the attention of the public and the media.

Second, anchor multiple objects and continue to tell emotional stories.

Ding Lei, the head of Netease, regarded Netease Cloud Music as Netease’s next fist product. In the cold winter of 2018, Netease abolished many businesses including "Netease Mint", and then sold Netease koala to Ali. However, it was once reported that the disc was played late at night, so Netease Cloud Music inexplicably added a layer of Ding Lei’s BUFF.

Moreover, the Netease business behind it has always been extremely dependent on games, and there is a lack of content platforms on products, especially on traffic platforms such as communities. As an independent product, Netease Cloud Music has actively attached itself, creating an illusion for the outside world, making the outside world think that Netease Cloud Music will bear the heavy responsibility of the group. Behind the investment in Netease Cloud Music, it is essentially investing in Netease and betting on the expectation that a "pro-son" will turn into a "prince".

Third, the topic sensitivity under "weak communication".

In the book "Weak Communication", a thought-provoking theory is told: the world of public opinion gives priority to the weak, and the strong dominates when competing for attention and the weak dominates when striving for recognition.

In real life, the most powerful are kings, bosses and elites; But in the songs, the most powerful people are civilians, soldiers and ordinary people. Working people are being sung, soldiers are being sung, children lang, tramps and bakers are being sung.

Netease Cloud Music has tasted the sweetness of "the advantage of the weak" in the field of public opinion in recent years.

For example, on August 31st, Tencent Music announced that it would give up its exclusive copyright, but Ding Lei said at Netease’s financial report meeting, "I hope it will be implemented sincerely, and don’t be duplicitous".

Over the years, Netease Cloud Music has thrown out some strange words from time to time to arouse the curiosity of the people who eat melons and create a weak image. However, in addition to "complaining about others", Netease Cloud Music has not made much moves in its own business development and innovation in recent years.

In this atmosphere, ordinary people who eat melons may be in the fog, but professional investors know that even if the copyright is further opened, it will only reduce the competition difficulty of Netease Cloud Music. It needs to be hard to strike the iron. The experience and historical experience of copyright opening in 2018 show that there is no robbing the rich to help the poor in the competition of commercial products, and we cannot hope for charity of competing products.

4. Conclusion

Investors are always sober, especially in the mature Hong Kong stock market.

In the listing ceremony, Netease Cloud Music played a "cloud ringing bell"-in addition to ringing the bell offline, Ding Lei also held the world’s first "meta-universe" listing ceremony through Netease Fuxi immersive activity system "Yaotai".

We can see that Netease Cloud Music is still telling stories, but this time it met with investors. The first day of the break shows that no one believes in this "fig leaf" and no longer pays for the so-called "feelings".

关于作者