Last winter, when global oil prices, gas prices and coal prices soared, Europe was the focus of international energy supply shortage. Due to the high dependence on foreign energy, the low natural gas inventory and the unexpected output of new energy, the fluctuation of fuel prices was transmitted to electricity prices, and many European countries experienced a sharp increase in energy prices in the second half of last year. So, how big is the impact of the energy crisis on the energy bills of household consumers?

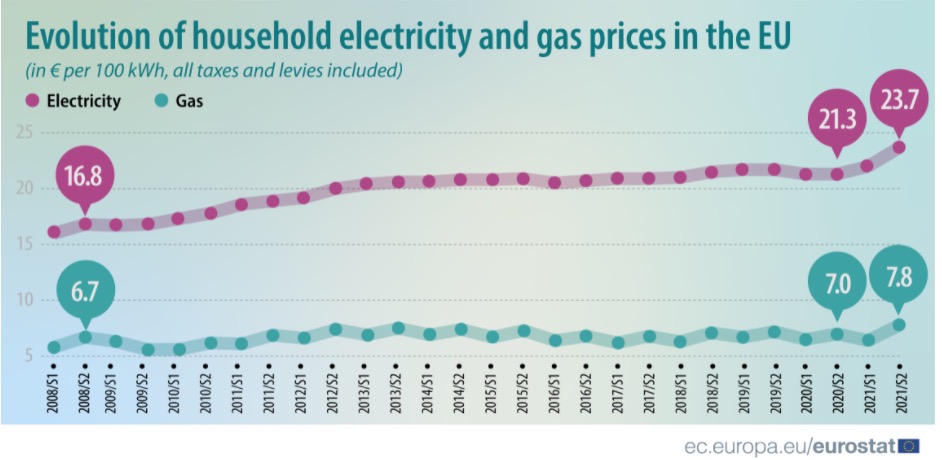

According to the data released by Eurostat recently, the average household electricity price in the EU increased significantly in the second half of 2021 compared with the same period in 2020, and the price per 100 kWh rose from 21.3 euros to 23.7 euros (note: kWh is abbreviated as kWh, which means the price per kWh is 0.237 euros), up more than 11% year-on-year. In the same period, the price of natural gas also increased significantly, from 7 euros per 100 kWh in the second half of 2020 to 7.8 euros. Recently, the wholesale prices of electricity and natural gas in the whole EU have risen sharply, which is driven by the changes in energy and supply costs caused by various economic factors.

Eurostat said that in the second half of 2021, taxes and fees accounted for 36% of household electricity bills and 30% of gas bills. Compared with the previous year, the price structure has not changed significantly.

Trends of household electricity price (red) and gas price (green) in EU since 2008 (unit is every 100 kWh, including taxes). Image source: Eurostat

Statistics show that, except Slovakia and Hungary, household electricity prices in other EU member States all rose in the second half of last year. Compared with the second half of 2020, in the second half of 2021, the largest increase (in national currencies) was in Estonia (+50%), followed by Sweden (+49%) and Cyprus (+36%).

The deeper the color, the greater the increase (the figure shows the year-on-year increase in the second half of 2021 compared with the second half of 2020, based on the currency prices of various countries. ) Image source: Eurostat

In euro terms, in the second half of 2021, the average household electricity price per 100 kWh was the lowest in Hungary (10.0 Euro, or 0.1 Euro/kWh), Bulgaria (10.9 Euro) and Croatia (13.1 Euro), and the highest in Denmark (34.5 Euro, or 0.345 Euro/kWh), Germany (32.3 Euro).

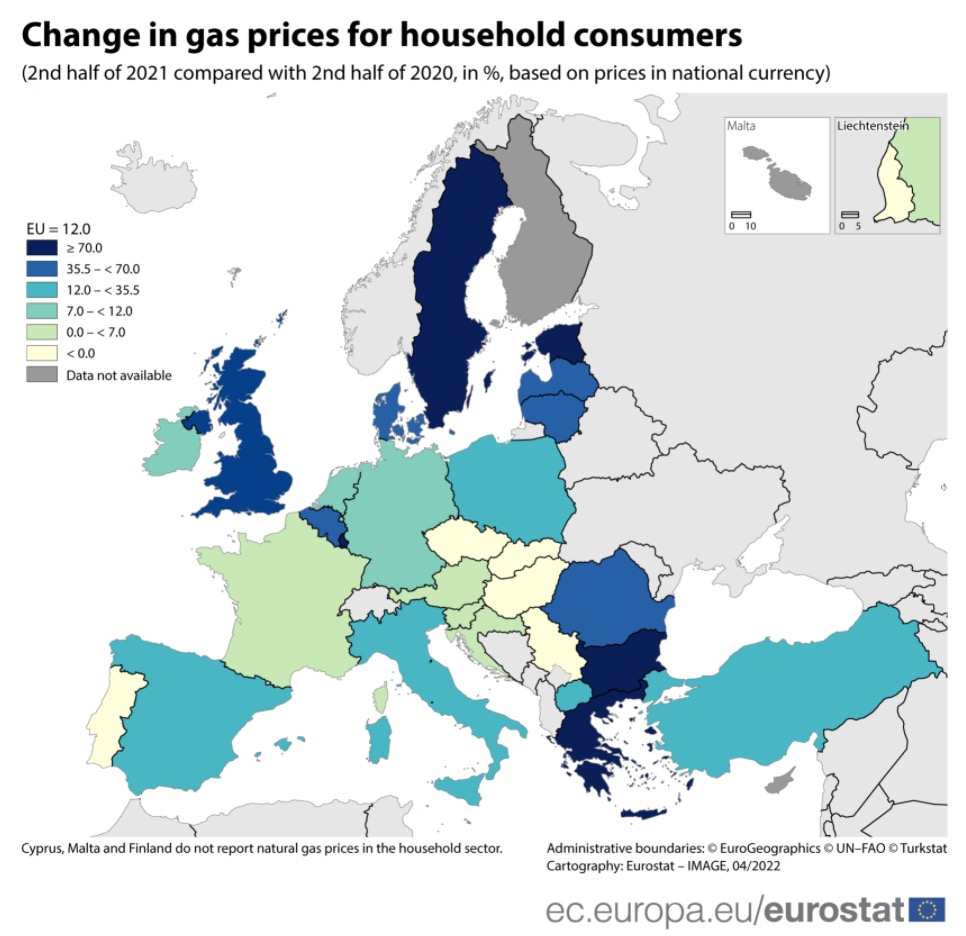

In terms of natural gas, among the 24 EU member states that reported the price of household natural gas, 20 member states experienced price increase. In terms of national currencies, the price of household natural gas increased the most in Bulgaria (+103%), followed by Greece (+96%) and Estonia (+83%). In contrast, only Slovakia, the Czech Republic and Portugal saw gas prices fall.

The deeper the color, the greater the increase. (The figure shows the year-on-year increase in the second half of 2021 compared with the second half of 2020, based on the currency prices of various countries. ) Image source: Eurostat

In terms of euros, in the second half of 2021, the average household gas price per 100 kWh was the lowest in Hungary (3.1 euros), Croatia (4.0 euros) and Lithuania (4.1 euros), and the highest in Sweden (18.6 euros), Denmark (12.5 euros), the Netherlands (11.0 euros) and Spain (10.8 euros).

Due to the different resource endowments and energy structures of European countries, the impact of rising fuel prices on electricity prices in 2021 is different, and the wholesale electricity prices in some areas remain stable and some areas have skyrocketed.

According to an analysis article by State Grid Energy Research Institute, Norway, for example, is rich in natural gas resources and 98% of its electricity supply comes from hydropower, so the overall price fluctuation is small. The average price in October remained at around 30 Euro/MWh. Although the average price rose in November and December, the annual average price was 35.02 Euro/MWh. The wholesale market prices in Spain, Britain, France, Germany and other countries have skyrocketed recently, and the average monthly market price before December has increased by 299% compared with the average price in the first half of 2021 & mdash; 406%。

Take Spain as an example, 1-mdash in 2021; In June, the average market price was 58.58 euros/megawatt hour, and the electricity price has continued to surge since July. In October, the average monthly price of the electricity wholesale market reached 207.49 euros/megawatt hour, and in December, the average monthly price of the electricity market continued to soar to 239.17 euros/megawatt hour, four times the average price in the first half of the year. On December 23 last year, the single-day wholesale electricity price reached the annual peak of 409 euros/megawatt hour.

According to the data of the above analysis article, in Germany, in June 2021, the average market price increased by 40.2% compared with May, reaching 74.33 euros/MWh; Since then, prices have continued to climb. As of December, the average monthly market price in Germany was as high as 221.06 Euro/MWh, compared with 1-mdash; The average price in June increased by 299.3%. The highest wholesale electricity price in a single day appeared on December 21st, which was 431.98 Euro/MWh.

However, it should be noted that,The surge in wholesale electricity prices does not mean that consumers will face the same increase in retail prices. The change of electricity price at the consumer side is also directly related to the structure of electricity sales contracts and the price supervision policies implemented by some countries on the retail market.Since the second half of last year, especially after the Russian-Ukrainian conflict aggravated the European energy crisis, most EU countries have adopted tax cuts and subsidies to protect consumers from the impact of soaring energy prices.

A typical example that can illustrate the difference between the two is the news that the electricity price in France has soared by 400% recently.The Paper inquired about the public data and found that the wholesale electricity price in France rose 3-4 times compared with the same period of last year. However, due to France’s regulatory measures to limit the rise in energy prices, the increase in electricity prices faced by consumers is limited to 4%.This will be maintained until the regulatory authorities next adjust the upper limit.

This soaring cost has not disappeared in thin air.The French power company (EDF), which is over 80% owned by the French government, should have made higher profits due to the sharp rise in electricity prices.

In January this year, after France announced to intervene and limit the increase in household energy prices, and EDF announced to extend the outage time of five nuclear power units and lower the annual nuclear power generation target, Fitch Ratings downgraded the independent credit status (SCP) of EDF from "bbb+" to "bbb", believing that the above factors would cause a major financial blow to EDF. The company believes that EDF’s EBITDA defined by Fitch in 2022 is about 4 billion euros, which is 75% lower than the previous estimate. Another market organization estimates that ED F will lose 7.7 billion to 8.4 billion euros in 2022 due to the government’s restrictions on electricity price increase.

Bruno lemerre, the French Finance Minister, said in January this year that if the government did not intervene, the electricity tariffs faced by the French people would rise by 35% to 40%.

From the above timeline, it is not difficult to see that the rise of electricity prices in Europe did not happen after the outbreak of the conflict between Russia and Ukraine, which was the result of multiple factors. However, in the face of the risk of Russian gas cut-off, the overall increase in the energy market this year is more intense than last year, and Europe will face a more significant increase in electricity prices.

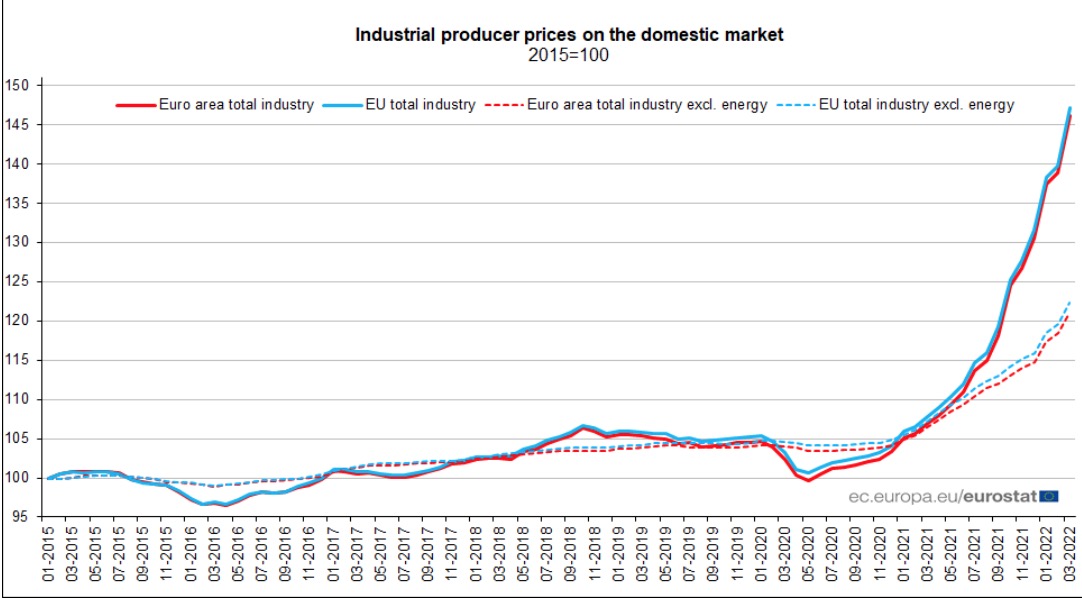

Eurozone and EU PPI rose sharply in March.

The industrial sector will be hit more directly. According to the data released by Eurostat on May 3rd, the Industrial producer prices in the EU increased by 5.4% month-on-month and 36.5% year-on-year. The main reason for the unexpected increase is the high energy price.

关于作者