The definition of mild diseases was introduced for the first time in the revision of relevant codes in critical illness insurance, and three core diseases, namely malignant tumor, acute myocardial infarction and sequelae of stroke, were divided into two levels according to their severity. In addition, from the perspective of protecting the interests of consumers, this revision has particularly optimized the risk margin. From the price point of view, for mainstream critical illness insurance products, under the premise of the same guarantee responsibility, the price of critical illness insurance products will drop slightly; For regular critical illness insurance products, the prices of some age groups will drop significantly.

Recently, insurance association of china and the Chinese Medical Doctor Association issued the Standard for the Use of critical illness insurance’s Disease Definition (Revised Edition in 2020), the Chinese Actuaries Association issued the Experience Incidence Table of Major Diseases in China’s Life Insurance Industry (2020), and China Banking and Insurance Regulatory Commission, China issued the Notice on Relevant Matters Concerning the Use of the Experience Incidence Table of Major Diseases in China’s Life Insurance Industry (2020). At this point, the relevant specifications of critical illness insurance, which the industry has been concerned about, have been revised.

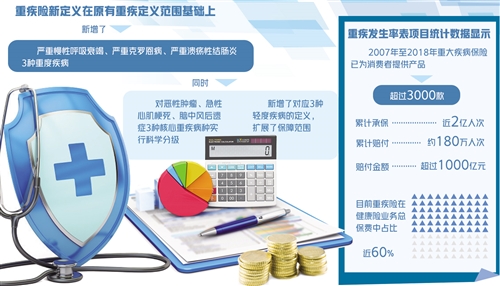

Statistics show that from 2007 to 2018 alone, critical illness insurance provided consumers with more than 3,000 products, covering nearly 200 million person-times, paying about 1.8 million person-times and paying more than 100 billion yuan. At present, critical illness insurance accounts for nearly 60% of the total premium of health insurance business, and the revision of relevant regulatory documents has a far-reaching impact on the development of life insurance industry.

The definition of mild diseases was introduced for the first time.

Jia Biao, deputy director of the Personal Insurance Department of China Banking and Insurance Regulatory Commission, China, said that critical illness insurance is an important type of insurance in China, and whether the definition of disease is scientific and reasonable is the core of the product protection responsibility of critical illness insurance.

The definition of mild diseases was introduced for the first time in the revision of relevant codes in critical illness insurance, and three core diseases, namely malignant tumor, acute myocardial infarction and sequelae of stroke, were divided into two levels according to their severity.

The relevant person in charge of insurance association of china said that through scientific classification, on the one hand, it has fully adapted to the development of medical diagnosis and treatment technology, and some diseases that used to be serious diseases, but currently have low medical expenses and good prognosis, are clearly defined as mild diseases, making the compensation standard more scientific and reasonable; On the other hand, it also adapts to the reality of critical illness insurance market development, and has formulated clear industry standards for mild diseases that are common in the market at present, so as to standardize market behavior.

In terms of the number of diseases and the scope of protection, the original definition of 25 serious diseases was improved and expanded to 28 serious diseases and 3 mild diseases, and the scope of protection was moderately expanded. Three kinds of severe diseases were added, namely severe chronic respiratory failure, severe Crohn’s disease and severe ulcerative colitis. At the same time, three definitions of mild diseases have been added to the scientific classification of three core serious diseases: malignant tumor, acute myocardial infarction and sequelae of stroke. Previously, the industry was more concerned about whether thyroid cancer would be excluded from the scope of critical illness protection, and a final conclusion was reached after the release of the new standard. This revision did not exclude thyroid cancer, but graded it according to the severity of the disease and paid it according to the severity.

According to the new standard, according to the severity of the disease, the expenses of diagnosis and treatment and the prognosis, the upper limit of the amount of insurance for mild illness is determined to be 30%. The insurance company shall reasonably set the corresponding insurance amount for minor diseases that are newly added in the critical illness insurance products.

According to the latest medical progress, the new standard also expanded the coverage of 8 diseases including major organ transplantation, coronary artery bypass grafting, heart valve surgery and aortic surgery, and improved and optimized the definitions of 7 diseases including severe chronic renal failure.

In addition, regarding whether cancer in situ is included in the scope of critical illness protection, after comprehensive consideration, this revision will not include cancer in situ for the time being. However, on the basis of diseases specified in the new regulations, insurance companies can add the responsibility of cancer protection in situ in critical illness insurance products to meet the diversified insurance protection needs of consumers.

Xing Wei, president of insurance association of china, said that after the implementation of the new regulations, insurance companies should further strengthen industry self-discipline, provide good customer service and ensure the smooth and orderly development of their business. At the same time, we will continue to strengthen cooperation with the National Health and Wellness Commission and the Chinese Medical Doctor Association, and explore the establishment and improvement of a long-term working mechanism for defining and standardizing serious diseases.

The revision of the list of serious diseases has laid a solid foundation.

If the revision of the definition of critical illness insurance disease gives consumers a new understanding of major diseases, then the revision of the new version of critical illness table provides an important information standard for insurance companies to design new products.

For the first time, the revision of the critical illness table has realized that data information covers all life insurance companies, all critical illness insurance products, all business links of underwriting and underwriting claims, and all historical data from the advent of critical illness insurance products to the end of 2018. A total of about 2,900 disease insurance products were sorted out, 160 diseases were extracted, nearly 400 million underwriting data and 5.87 million claims data were collected, and manual supplementary records were implemented for about 750,000 claims with incomplete information. In addition, the Chinese Actuaries Association also made full use of new technologies such as artificial intelligence, new methods such as machine learning model and new tools such as automatic cleaning of claims texts, and completed the classification of claims texts of more than 5 million claims cases, as well as the subdivision of claims for 105 serious diseases, 55 mild diseases, 26 cancer sites and 80 causes of death, and formed technologies and application tools that can be directly exported to the outside industry.

It is worth mentioning that in this revision, the exclusive reference table of the total experience incidence rate of diseases in Guangdong-Hong Kong-Macao Greater Bay Area under the 2020 edition definition specification was compiled for the first time, which plays an important role in the innovative development of exclusive products in Guangdong-Hong Kong-Macao Greater Bay Area. For the first time, the reference table of the incidence of two representative sexually transmitted diseases of the elderly under the 2020 version of the definition specification was compiled, which created a precedent for the research and analysis of the incidence of serious illness experience of the elderly, and was of great significance to the innovation and supply of exclusive insurance products for the elderly.

Li Jinsong, deputy secretary-general of China Actuaries Association, said that the release of the revised list of critical illness is an important measure for the insurance industry to implement the important spirit of the CPC Central Committee and the State Council, strengthen the infrastructure construction of the insurance industry, structural reform of the supply side of service finance, and prevent and resolve financial risks. It is also an important measure for implementing the strategic deployment of the CPC Central Committee and the State Council on the construction of Guangdong-Hong Kong-Macao Greater Bay Area, "Healthy China 2030" and promoting the development of aged care services, which is of great significance in promoting the high-quality development of the insurance industry, adhering to long-term stable operation, and protecting consumers’ rights and interests.

In the next step, under the guidance of China Banking and Insurance Regulatory Commission, China, China Actuaries Association will further play the role of professional platform, gather the strength of the whole industry, explore the establishment of a long-term working mechanism for dynamic adjustment of critical illness tables, and better serve the development of health insurance industry.

There will be new changes in the pricing of new products

Faced with the revised new specification and the new version of critical illness table, consumers are most concerned about what changes will be brought by critical illness insurance products.

According to Jia Biao, the transition period of critical illness insurance products is from the date of publication to January 31, 2021. After the transition period, companies are not allowed to continue to sell critical illness insurance products developed based on the old specifications. This means that before the end of the transition period, products that have passed the filing can continue to be sold, and new products will also be listed for sale if they pass the filing. However, insurance companies may upgrade or stop selling old products one after another based on multiple factors such as rates and prices.

The reporter consulted a number of life insurance companies and learned that after the relevant regulatory documents were released for comments, various insurance companies have started the calculation and adjustment of critical illness insurance products. With the release of the new regulations, new products will be submitted to the regulatory authorities for the record, and will be listed for sale after passing. In this regard, Jia Biao said that China Banking and Insurance Regulatory Commission requires insurance companies to develop critical illness insurance products that meet the requirements of the new regulations. Companies should also strengthen sales management, and it is strictly forbidden to mislead sales by switching between new and old norms, and it is strictly forbidden to stop selling by speculation.

Regarding the price of new products that consumers are generally concerned about, the relevant person in charge of the China Association of Actuaries said that there are many factors that affect the price of critical illness insurance products, including guarantee responsibility, interest rate, expense rate, and the incidence of serious illness. Different products have different sensitivities to various factors, and the incidence of serious illness is one of the important factors. From the perspective of protecting the interests of consumers, this revision has particularly optimized the risk margin. From the price point of view, for mainstream critical illness insurance products, under the premise of the same guarantee responsibility, the price of critical illness insurance products will drop slightly; For regular critical illness insurance products, the prices of some age groups will drop significantly. (Economic Daily China Economic Net reporter Yu Yong Li Chenyang)

关于作者